|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

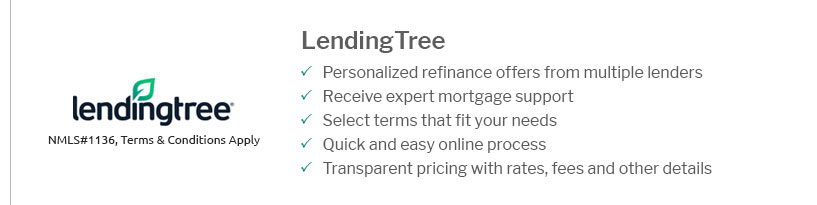

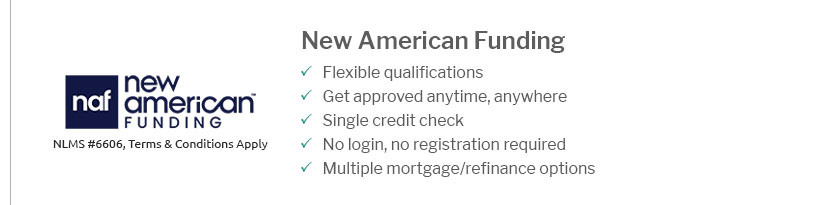

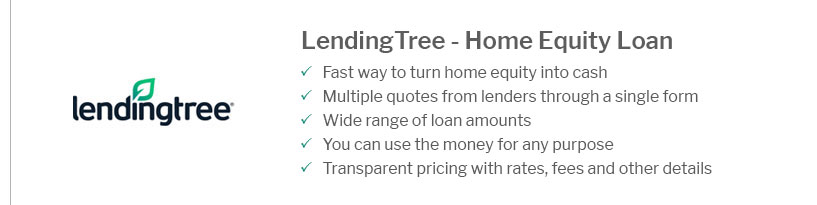

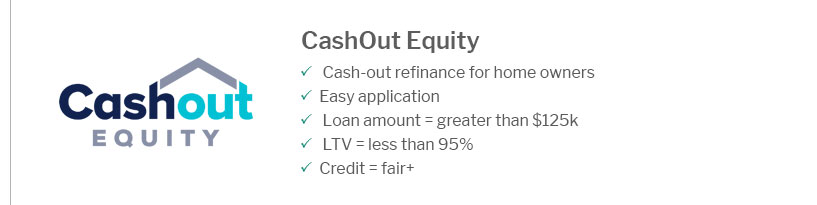

Exploring the Best Refinance Banks: A Comprehensive GuideWhen considering refinancing your home, choosing the right bank is crucial. This guide will walk you through what makes a bank ideal for refinancing, key factors to consider, and a list of some top contenders. Factors to Consider When Choosing a Refinance BankChoosing the best refinance bank involves more than just comparing rates. It's important to evaluate several key factors. Interest Rates and FeesInterest rates are a primary concern when refinancing. Look for competitive rates that align with your financial goals. Additionally, be aware of associated fees. For more details on refinancing costs, visit the average cost to refinance house resource. Customer Service and SupportA bank's customer service can significantly impact your refinancing experience. Look for banks with strong customer reviews and robust support systems. Loan Options and FlexibilityConsider the range of loan options available. Flexibility in terms and conditions can make a bank more appealing. Top Refinance Banks to ConsiderHere are some banks that consistently rank highly for their refinance offerings.

Regional ConsiderationsYour location can affect your refinancing options. For instance, the best home refinance rates Florida offers may differ from those in other states. FAQs About RefinancingWhat is refinancing?Refinancing involves replacing your current mortgage with a new one, typically to secure better terms or lower interest rates. How do I qualify for refinancing?Qualification criteria include having a good credit score, a stable income, and sufficient home equity. Can refinancing save me money?Yes, refinancing can lower your monthly payments or reduce the total interest paid over the life of the loan, depending on the new terms. https://www.creditkarma.com/shop/autos/index/type/refinance

An auto refinance could result in a lower monthly payment or rate. Read our take on the best auto refinance loans and rates and see estimated terms. https://www.quora.com/What-is-the-best-bank-to-refinance-or-start-a-new-mortgage-with-in-San-Francisco-California

I am a private money lender and guarantee you do not want to borrow from me as I work with contractors and similar who build new houses or ... https://www.nerdwallet.com/refinancing-student-loans

When you refinance student loans, you can save money by replacing existing education debt with a new, lower-cost loan through a private lender.

|

|---|